While self-service data analytics requires the right technologies, promoting the use of data throughout an organization demands strong data literacy and non-intrusive governance, as well. During our webinar, How to Scale Self-Service Analytics for Smarter Decision-Making, we spoke with John Ackerman, VP of Data and Analytics at Affinity Federal Credit Union about their success with adopting a modern data architecture and facilitating data empowerment.

Affinity Federal Credit Union is the largest member-owned credit union in New Jersey, with more than 20 branches across the tri-state area. Through its innovative use of technology, Affinity has implemented a scalable self-service data analytics program that promotes stronger data literacy and more data-driven business operations.

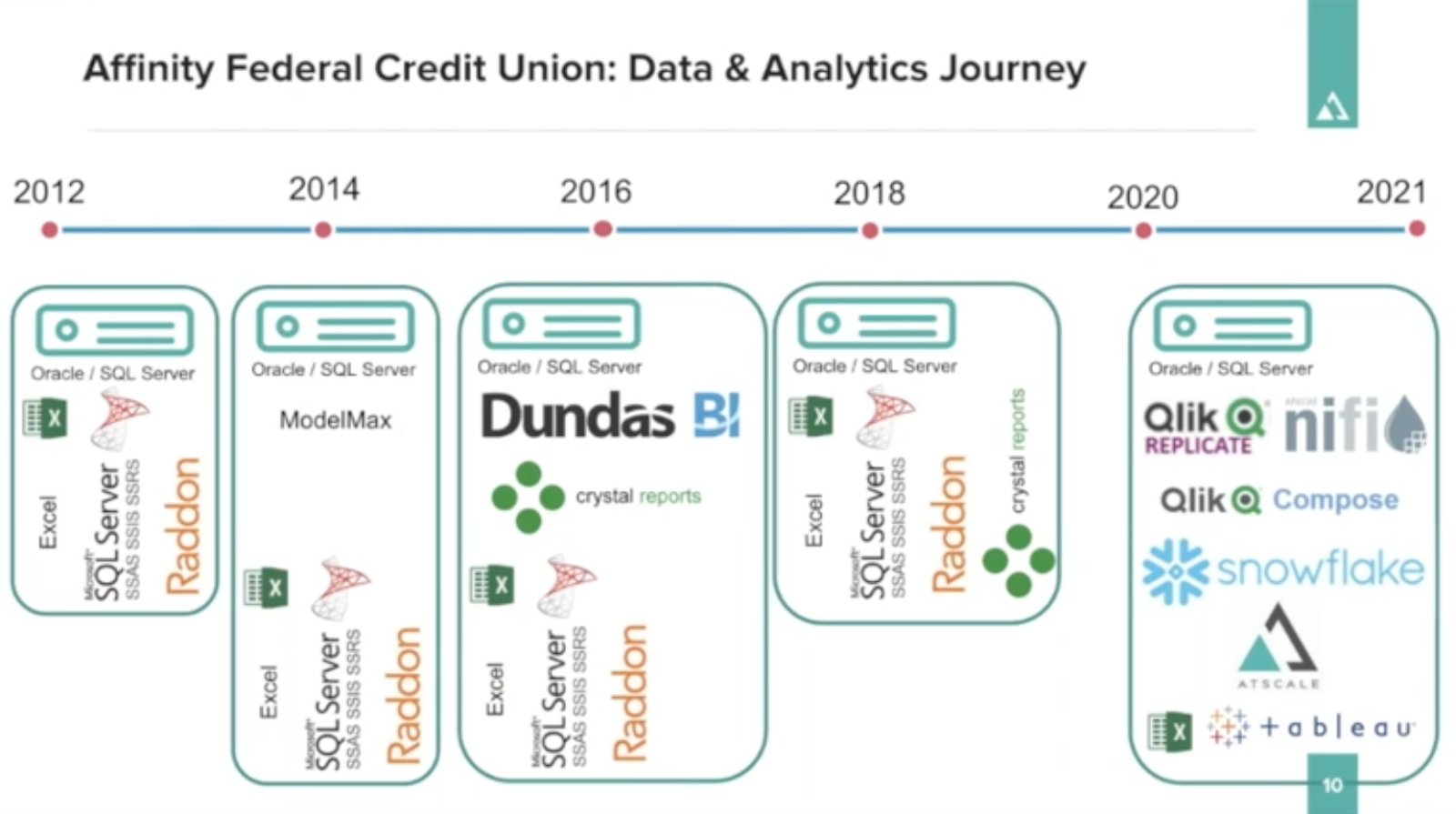

Here’s how Affinity’s data architecture and its roadmap for self-service data analytics has evolved.

A History of Data Analytics at Affinity

Throughout the years, Affinity’s data and analytics journey involved a wide variety of tools for data storage and business intelligence. For example, Affinity adopted a new tool called ModelMax around 2015 for both descriptive and predictive analytics. While ModelMax was designed for ease-of-use, the organization found that it wasn’t easy enough for most business users and required help from a specialized analytics team.

Similarly, Affinity implemented Dundas BI because it was extremely customizable, but the reporting suite came at a high cost and failed to gain widespread adoption throughout the organization. The problem was that these legacy tools required too much manual effort—which the company termed “human middleware”—in order to make business decisions from the data.

During this time, Affinity had no central administration for reporting across the organization. The lack of data governance and no single source of truth meant there were a lot of reports being distributed that didn’t provide enough actionable insights. Affinity’s legacy approach didn’t give business analysts the tools and guidance they needed to effectively access and analyze data.

Adopting a Credit Union Service Organization

Many credit unions like Affinity eventually shifted to a credit union service organization (CUSO), which offered data analytics as a service. Affinity could send data to the CUSO and get back advanced analytics reports. This essentially outsourced data analytics to the CUSO, but also forced Affinity to give up some of its intrinsic knowledge capital. While CUSOs were suitable for many organizations, Affinity wanted a longer-term data solution that supported its broader business goals and formed a source of competitive differentiation..

“We did manage to skip the Hadoop and big data era, which provided a good platform for many other organizations,” Ackerman explained. “But with the credit union space being smaller and member-oriented, CUSOs supplied a similar service for our organization during this phase of data analytics.”

Modernizing its data and analytics efforts meant moving away from the CUSO approach towards a more autonomous solution. This would allow Affinity to build internal capability to drive data literacy and support future initiatives including data science and advanced analytics, and more.

A Self-Service Data Analytics Roadmap

Affinity’s modern roadmap to self-service data analytics defines two main pillars: data empowerment and data architecture.

Data Empowerment

Affinity’s primary focus is to protect the interests of its members “Data empowerment” is the term the organization coined for its governance efforts designed to support this focus. By empowering employees through education and information rather than strictly governing data usage throughout the organization, Affinity is able to operate as a more data-driven business.

“We didn’t want to push our business into a state that says we must govern data,” Ackerman explained. “Instead, we’re empowering employees to actually move in a direction to be able to make data-driven decisions on that data. The goal is to be transparent, supportive, and collaborative with our business.”

Another key aspect of data empowerment at Affinity was the focus on no- or low-code solutions to democratize data and analytics. By connecting its data sources to business intelligence tools like Tableau and Excel via a semantic layer, Affinity now enables citizen data analysts to put data at the forefront of business decisions. Moreover, self-service data discovery through data curation and metadata pushes this data literacy even further. That way, the entire organization can leverage data as a strategic asset.

Data Architecture

Along with data empowerment throughout the organization, Affinity views its data architecture as an enabler for self-service analytics. The organization is focusing on building a practice around its modernized data architecture that combines people, processes, and technology into a scalable and performant solution. This includes defining an information value chain for creating transparency around how data flows throughout the organization.

Affinity also shifted where data is stored and how it’s accessed by business intelligence software using AtScale’s semantic layer. The semantic layer sits between Affinity’s data, which is being migrated from traditional on-premises Oracle databases to Snowflake, and the business intelligence tools. Through this centralized data access layer, Affinity’s business analysts can leverage data virtualization to consume information stored within this hybrid Snowflake and Oracle data architecture.

Looking Toward The Future

Affinity has seen enormous success by implementing its two pillars for self-service data analytics. In the future, however, the organization hopes to use its modern data architecture with AI and machine learning algorithms, while continuing to empower more employees to become citizen data analysts through advanced data literacy.

Interested in learning more about self-service data analytics using AtScale’s universal semantic layer? Watch our full webinar with General Mills, EverQuote, and Affinity Federal Credit Union here.

SHARE

Case Study: Vodafone Portugal Modernizes Data Analytics