This blog is part of a series on Microsoft Fabric from Greg Deckler, Vice President at a global IT services firm who leads a practice specializing in Microsoft technologies such as Dynamics 365, Power BI, and Azure. Greg is a seven time Microsoft MVP for Data Platform. He is the author of six books on analytics and Microsoft Power BI. Follow Greg on LinkedIn, X and on GregDeckler.com.

Part 3 – Time Will Tell

This is the third part of a three-part series exploring Microsoft Fabric, and specifically Direct Lake, and whether or not these technologies and systems create a competitive advantage in the highly competitive data analytics market.

Introduction

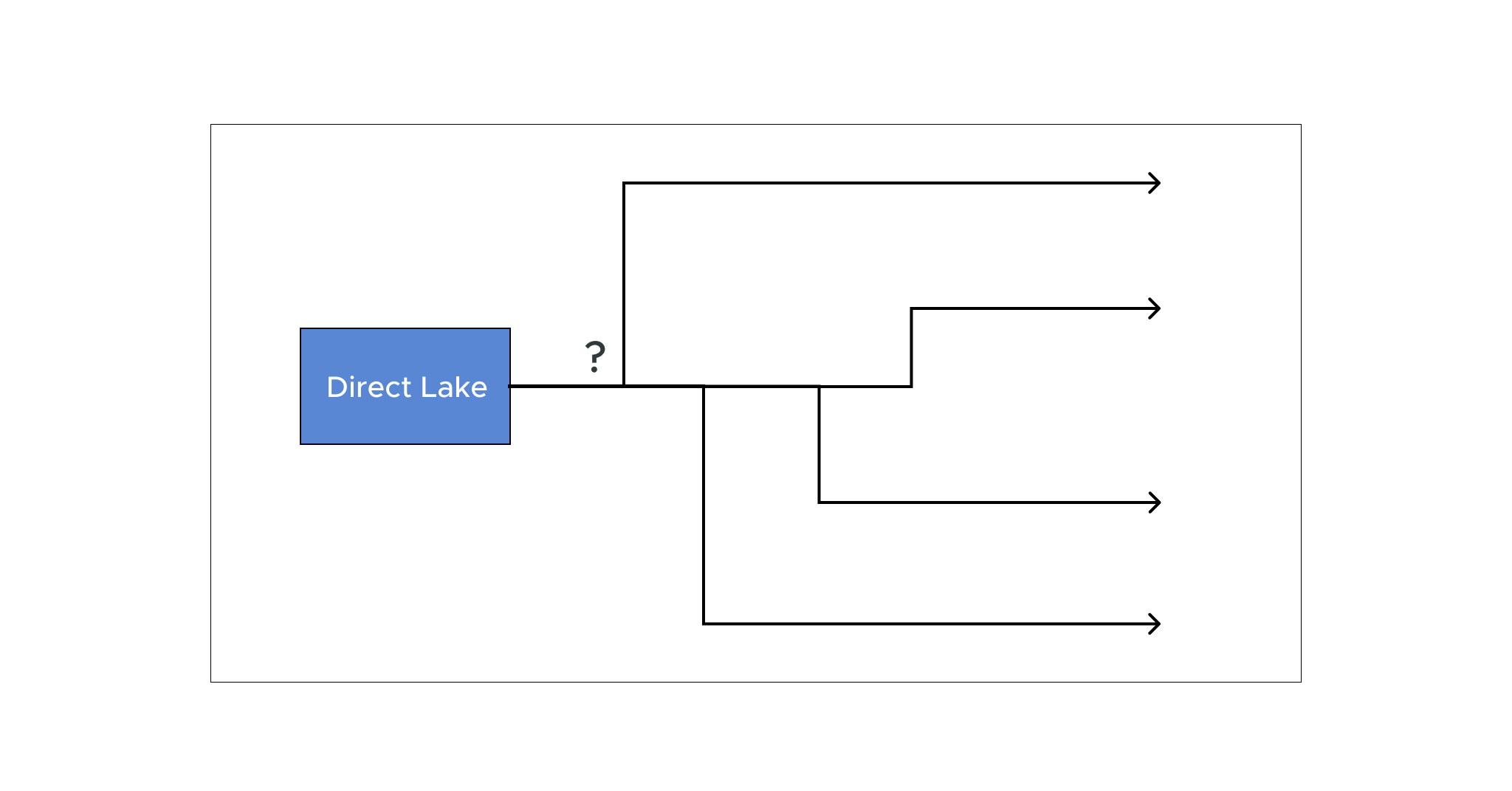

In Part 1 of this series, we briefly explored Microsoft’s history in the enterprise data analytics space and provided an overview of Microsoft’s Fabric, Direct Lake, and Lakehouse technologies. In Part 2, we focused on the limitations of these technologies and the impact of these limitations on their applicability within enterprise data analytics workloads. Here we saw that Direct Lake has incredibly limited use cases, not only because of its limitations but also because it does not replace import or DirectQuery models. Instead, Direct Lake rather helps solve a small, niche percentage of otherwise problematic semantic models and even then its current limitations severely limit its applicability.

Given the incredibly small percentage of semantic models where Direct Query can be implemented, it is impossible to see how Direct Lake itself is a game changer or even a blip on the radar with regard to reversing Microsoft’s fortunes in the data analytics space. But what about Fabric in general? Does Fabric provide an overall competitive advantage that can help Microsoft succeed against competitors such as Snowflake and Databricks after many decades of lackluster performance? That is the subject of Part 3 of this blog series.

Fabric Has At Least Changed the Conversation

It must be acknowledged that Fabric, in a way, has already been a game changer for Microsoft. Quite simply, the announcement and subsequent hype regarding Fabric has at least put Microsoft back into the conversation around enterprise analytics. This is quite a change as Microsoft had largely been written off in this space in favor of Databricks, Snowflake, Amazon, Google, and other players in the enterprise analytics space. Some may take issue with this characterization, but Synapse generally could not compete with the likes of Databricks and Snowflake and was being outpaced by Amazon and Google. Similarly, Power BI Premium could not handle a variety of enterprise data analytics workloads either such as true, enterprise-class data science.

Fabric, to some degree, “froze the market”. Marketing blurbs around the “game changing” nature of OneLake for “simplifying” storage and “groundbreaking” technologies like Direct Lake gave many pause to consider their current trajectory around enterprise analytics. However, a year later these marketing blurbs have lost their luster as the realities and limitations of these technologies have become known. This blog series has shown the significant limitations within Direct Lake, limitations that have been echoed in other, independent blogs such as sql.bi and sqlserverbi.blog. In terms of OneLake, Databricks has a similar technology called, Unity Catalog, and Snowflake has always used a central repository for data that all compute nodes can access. In addition, Microsoft’s move toward an open data file format, Delta, was anticipated and preceded by Snowflake, Google, and Cloudera adopting Apache Iceberg. Google and Snowflake have since added Delta support as well.

Now that some amount of reality has set in around Fabric and the honeymoon phase wears off, let’s discuss how Fabric might succeed or fail in the long term.

How Fabric Can Succeed

Microsoft is certainly not relying on simply marketing blurbs when it comes to Fabric’s success. Primarily, we see two main strategies that Microsoft is employing in order to attempt to ensure Fabric’s success long term.

Force Customers onto Fabric

Microsoft is making unprecedented moves to force customers onto Fabric. This was most recently seen with Microsoft retiring Power BI Premium licensing. Even customers with an existing Enterprise Agreements (EA) will be forced onto Fabric licensing as of January 1st, 2025. To understand the significance of this event, consider that Microsoft has almost never retired a SKU…ever.

For an easy contrast, consider how Microsoft handled the unbundling of Microsoft Teams from Office. In that case, customers that have existing SKU’s that include a bundled Teams license for Office can continue to renew those licenses in perpetuity. Only net new customers must purchase Teams separately from Office. This is the normal way in which changes to licensing terms are conducted, with the existing customers being grandfathered into the old licensing terms.

The unprecedented nature of the actual retirement of an SKU simply demonstrates the lengths Microsoft is willing to go to in order to make Fabric a success.

Remove Barriers to Entry

We covered shortcuts in Part 2 of this blog series. It is no mistake or coincidence that Snowflake and Google are effectively half of the supported data sources for shortcuts. Microsoft is intentionally positioning Fabric as an enterprise analytics hub with the likely goal that if you don’t bring your data into Fabric, Fabric can still bring the analytics to the data. This can be a powerful message as this eases the adoption barrier for Fabric. By avoiding the costly proposition of moving data from other analytics platforms, the barrier for entry into organizations at least leveraging Fabric for certain analytics workloads is greatly reduced. This message could be even more effective when coupled with the next strategy, paying for things twice.

Paying for Things Twice

Forcing customers into Fabric licensing and attempting to remove the barriers to entry for leveraging Fabric within the enterprise are simply the tips of the spear. The real end game lies in a proven Microsoft tactic, convincing corporate executives that they are paying for the same thing twice.

The best example of this tactic, or at least the one that I am most familiar with, is actually Microsoft Exchange. At the time of Microsoft Exchange’s release, Novell was still very much the leader in the market. Certainly, Windows NT’s introduction in 1993 damaged Novell, but the real final nail in the coffin was arguably the incredible popularity of Microsoft Exchange. Running Microsoft Exchange as your corporate, enterprise email system meant that you were required to run Windows servers which literally meant that you were paying for the same services, file sharing, print sharing, and directory if you were still running Novell. In effect, Microsoft Exchange became the “killer app” for Windows servers.

Microsoft seems bent on attempting a similar tactic with Fabric. But by forcing customers to adopt Fabric licensing and reducing the barriers to entry to working with Fabric, sales executives will eventually move on to trying to convince corporate executives that regardless of what enterprise data analytics platform is currently in use, Microsoft Fabric is capable of handling those workloads and since those organizations already need Power BI for reporting, those organizations are effectively paying for twice for enterprise analytics software. In other words, Microsoft will use Power BI as the “killer app” to prop up Fabric and supplant competitors.

How Fabric Can Fail

Given how competitive the enterprise data analytics space is, the success of Fabric is certainly not something that is guaranteed. While Microsoft has certainly won its fair share of technology wars over the years, the enterprise data analytics space is quite unlike any before. As mentioned previously, Windows servers really only had a single entrenched competitor. The office wars were fought against two competitors, Novell and Lotus. The browser wars against one, Netscape.

The enterprise data analytics space is much more complex and diverse, with many more competitors than just one or two. Within the data analytics space, there are smaller players like Databricks and Snowflakes, larger players like Amazon, Google, and Cloudera, and specialized vendors such as AtScale. Many of these vendors are laser-focused on achieving dominance within the enterprise data analytics space, constantly pushing the limits of technology, driving out complexity, and reducing costs.

Let’s look at a number of ways in which Fabric may not live up to the hopes of Microsoft executives.

Failure to Convert Existing Customers

Currently, Microsoft appears focused on converting enterprise customers to Fabric, through absolute brute force if necessary. However, Microsoft has a significant number of small and medium sized customers that are avid users of Power BI and Synapse. These customers are perhaps just as critical to the success or failure of Fabric as enterprise customers. Yet, Microsoft has done very little to court these customers or make it easy for these customers to embrace Fabric.

For existing, non-Premium Power BI customers, there is little compelling reason for such customers to embrace and use Fabric. Power BI essentially fulfills most, if not all, of their existing business requirements. Data can be ingested from source systems into a semantic model, published to the Power BI Service, and shared between colleagues all for $10/user/month which includes all compute and storage costs.

The smallest Fabric capacity, an F2, is $262.80 per month or $156.33 for a 1-year reserved instance. This is just the compute, then there are additional costs for storage. Exactly what workloads does Fabric bring to the table for these small to medium businesses that justify this expense? Certainly, cases can be made but Microsoft does not seem to have a clear message here.

The story is even worse for existing Synapse Analytics users. Synapse Analytics has a licensing model that is incredibly favorable to customers as customers are only charged for what they actually use. Thus, Fabric’s capacity-based pricing could be a tough sell to these customers, many of whom have built enterprise-grade data analytics workloads at a fraction of the cost of Microsoft Fabric’s lowest level F2 SKU price.

The other issue with Synapse is the lack of any kind of coherent or easy migration path between Synapse and Fabric. To a large degree, Synapse users are left having to manually migrate code or, worse, effectively starting from scratch if attempting to migrate many workloads to Fabric. The lack of an easy migration and potentially higher costs are generally not a winning formula in winning over existing customers to a product.

Too Little Too Late

Given that Google BigQuery debuted in 2010, Amazon Redshift and Snowflake in 2012, and Databricks in 2013, Microsoft’s first serious entry into the enterprise data analytics space of Azure SQL Data Warehouse in 2016 and subsequently Azure Synapse Analytics in 2019/2020 is quite late. Ever since, Microsoft has been fighting an often losing battle to entrenched players.

With more or less a decade passing since the cloud enterprise data analytics wars kicked off, many enterprise customers have already chosen a horse in the race. Convincing these enterprise customers to abandon years of investment in stable platforms that currently deliver consistent business value is a tough road to travel in even the most favorable conditions. Fabric would need to deliver a quantum leap forward in terms of functionality, performance and/or costs.

Most unbiased industry observers do not perceive Fabric as a quantum leap forward in any of those categories. At best, some industry observers have observed in the months after Fabric’s announcement that Fabric possibly gave Microsoft a “slight lead” in the space. However, given how competitive the enterprise data analytics landscape is “slight leads” do not tend to last very long and there have already been moves by Microsoft’s competitors to close any perceived gaps. Add to this the long laundry list of limitations within Fabric and it is quite possible that the introduction of Fabric is simply too little too late.

Legal Trouble

Microsoft is no stranger to running into legal trouble regarding their competitive practices. And, given the stakes involved in the enterprise data analytics space, it is reasonable to at least postulate that the aggressive moves being made by Microsoft in regard to Fabric could potentially land it in legal hot water.

There are two main sources of potential litigation that could possibly be pursued against Microsoft when it comes to Fabric. The less likely of the two is that current Power BI Premium customers file a class-action lawsuit against Microsoft for retiring Power BI Premium licensing and forcing them onto the more expensive Microsoft Fabric licensing model.

Note that a Power BI Premium P1 instance includes all compute and storage (up to 100TB) plus on-premises rights for Power BI Report Server (PBRS) for an MSRP of $4,999 per month. An equivalent Microsoft Fabric F64 SKU costs $5,002.67 per month just for compute with storage an additional $0.026 per GB. In addition, the F64 SKU does not include any rights for PBRS.

While perhaps not a likely scenario, the almost unprecedented nature of Microsoft retiring a SKU completely even for existing EA customers in the middle of their contracts might give courts a reason to rebuke Microsoft.

The more likely scenario is Microsoft’s old nemesis, the European Union (EU). The EU is the reason why Microsoft uncoupled Teams from Office, in order to stave off an anti-trust investigation originally brought by Slack, a competitor to Teams. The EU is also the reason Microsoft was forced to decouple Internet Explorer (IE) from Windows over a decade ago, it’s most recent regulatory issue prior to the Teams unbundling.

Given this history, it is plausible that competitive reporting tool vendors could complain to the EU with regards to effectively bundling Power BI licensing with Fabric licensing. There is no real need for Fabric with regards to Power BI. Power BI is a perfectly capable product on its own. The same is true for Fabric. Power BI is not essential for Fabric workloads. Thus, similar to how Microsoft’s bundling of IE in Windows and Teams in Office was viewed as anti-competitive by the EU, the same could hold true for the EU’s views towards bundling Power BI with Fabric as being anti-competitive with competing reporting tools such as Qlik Sense, Tableau, Looker, Domo, etc.

Clearly, forcing Microsoft to unbundle Power BI from Fabric would deal a critical blow to the “paying for things twice” argument as customers would once again be able to run Power BI standalone without Fabric workloads.

Conclusion

Ultimately, only time will tell if Fabric is a game changer and can reverse Microsoft’s fortunes in the enterprise data analytics space. There are paths towards victory for Microsoft but there are also significant pitfalls. Given the limitations of Microsoft Fabric covered in this blog series as well as AtScale’s TPC-DS Benchmark for Power BI/Direct Lake and the limited potential impact of Fabric’s most highly touted features such as Direct Lake and OneLake, it is difficult to see a mass exodus from competitive analytics platforms occurring and massive adoption of a relatively immature enterprise data analytics platform in the near term. Regardless of whether Microsoft succeeds or fails in the future, it will be a long hard slog for everyone involved and ultimately will not be a resolved question even a decade from now, if ever.

SHARE

How Does Power BI / Direct Lake Perform & Scale on Microsoft Fabric