When the World Health Organization (WHO) officially declared the COVID-19 outbreak a pandemic on March 11th, 2020, there was widespread uncertainty over how it would impact public health, the global economy, or the retail sector. The State of COVID-19 Impact on Retail report outlines three key findings and takes a deep dive into the retail sector. Here are three key findings pulled together in the report by AtScale’s Peter Dolan, Gergana Illeva, and Stella Valcheva:

- U.S. retail recovery has lagged behind Canadian retail recovery

- The downturn in retail sub sectors comprised of “essential businesses” has been much less severe and the recovery more robust

- Online (non-store) retail volume has soared, while the “clothing and clothing accessories” sector continues to struggle to regain its foothold

| NOTE: AtScale powers the analysis used by the Global 2000 to make million dollar business decisions. This report was generated using AtScale’s Intelligent Data Virtualization™ platform with public and private data sets housed in Snowflake and Google BigQuery that were virtualized, modeled and made available for analysis in Microsoft Excel, Microsoft Power BI, and Tableau using AtScale’s Universal Semantic Layer™. |

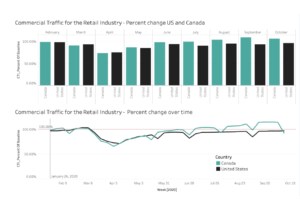

US retail recovery lags behind Canadian retail recovery

While at first the trends were similar across the US and Canada, the US recovery has since lagged the recovery in Canada. Retail commercial mobility first exceeded the pre-pandemic benchmark in Canada in early July, while the recovery in the United States has been more gradual. As of the end of September, the US is still 2% off the pre-pandemic benchmark while the commercial retail mobility in Canada is 28% higher.

The downturn in retail sub sectors comprised of “essential businesses” was much less severe and the recovery more robust

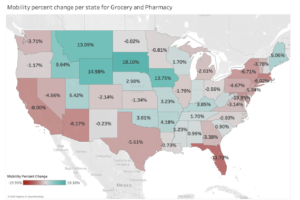

Google’s Community Mobility report sheds light into how individuals’ behavior has changed in comparison to a pre-pandemic baseline.

While the data shows a decline in the number of visits to grocery and pharmacy locations across the United States at the pandemic’s onset, activity has virtually returned to normal. In comparison, visits to retail and recreational locations plummeted more than 50% by mid-April, and as of this writing, are still down by more than 10%.

Non-store (online) retail volume soars, while the clothing and clothing accessories sector struggles to regain its foothold

| Retail Trade Volume ($ Million) | |||

| NAICS subsector | March – September 2019 | March – September 2020 | Year over Year Growth |

| Nonstore Retailers | 442,194 | 546,529 | 23.59% |

| Building Material and Garden Equipment and Supplies Dealers | 238,106 | 272,844 | 14.59% |

| Food and Beverage Stores | 447,876 | 510,364 | 13.95% |

| General Merchandise Stores | 409,318 | 418,797 | 2.32% |

| Sporting Goods, Hobby, Musical Instrument, and Book Stores | 45,855 | 45,971 | 0.25% |

| Health and Personal Care Stores | 207,668 | 208,193 | 0.25% |

| Motor Vehicle and Parts Dealers | 752,981 | 723,517 | -3.91% |

| Miscellaneous Store Retailers | 79,557 | 74,255 | -6.66% |

| Furniture and Home Furnishings Stores | 68,942 | 59,994 | -12.98% |

| Electronics and Appliance Stores | 52,975 | 42,003 | -20.71% |

| Gasoline Stations | 306,574 | 239,396 | -21.91% |

| Clothing and Clothing Accessories Stores | 152,124 | 90,131 | -40.75% |

Conclusion: Online Shopping Is Here to Stay. It’s Anyone’s Guess How Holiday Shopping Will Look for Traditional Retailers.

Now six months after the WHO’s official declaration of the COVID-19 pandemic, policy makers, business owners, retailers, and voters are still grappling with the question “What happens next?” Leveraging today’s analytical tools and combining diverse, dynamic data sets is key to understanding society’s response to the evolving public health crisis. As more data becomes available, key stakeholders can test their hypotheses, monitor new trends, and better prepare for an uncertain future. It’s anyone’s guess how the holiday shopping season will look.

For more information:

- Download the State of COVID-19 Impact on Retail report

- Listen to the CHATScale podcast.

- Check out the AtScale Data Insights Marketplace often to see new data and sign up to learn more about what the data is saying about our return to “normal” and draw your own conclusions.

SHARE

Guide: How to Choose a Semantic Layer